Bi Weekly Budget Template | An Easy Way To Plan Monthly Budget

Bi Weekly Budget Template

Budgeting has often been described as a necessary evil. It is not deemed a lot of fun to do, but most entrepreneurs consider it crucially important. No project can be considered viable unless you have a budget, no matter how big or small the project. Budgeting provides you with a guideline to monitor your expected income and expenses and measure that against your anticipated financial goals and numbers. It can also give you greater control over your money and resources, including human resources.

If it is done correctly, budgeting should help your business save money without cutting too many corners. Budgeting will also help your business in countless ways in the long run. If you continue to deliver your projects on time and on budget, you will likely continue to develop a reputation as a reliable and professional partner for your clients and your employers.

Importance Of Budget In Corporate:

As budgeting allows corporate to create a spending pattern. Once you create a budget plan for a specific project, it allows you to keep your finances organized and on track regarding how to control debt and other incurring expenses. You can easily sketch out a budget for 6 months or weekly; by doing this, you can access and forecast as to on which week your money was implicit or surplus. You can further look for ways to even out the peak and lows in your finances so that it can be more manageable and pleasant.

In reality, project managers spend most of their time and effort in completing the project and forget about monitoring and controlling their money spent on unnecessary costs. The project manager's core task is the successful execution of the project within the estimated budget and the stipulated time. The three factors which constitute a project are budget, time, and quality are the backbones of any project or goal.

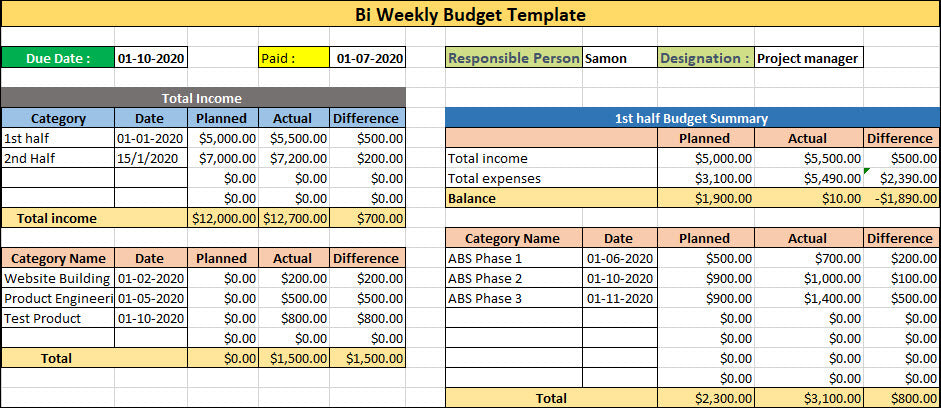

To that end, having a bi-weekly budget template helps you utilize budgeting to the fullest extent. What separates the bi-weekly budget template apart from any other budgeting template is that as a fully functional template, it is designed to track every income and expense as simply and as accurately as possible so that you can keep on top of your company’s finances.

Key Details To Include In Bi Weekly Budget

To assist you, we have provided a list of the key details you need to include in your bi-weekly budget template to maximize your budgeting success.

Monthly Budget Based On Bi-Weekly Pay Template

Traditionally speaking, budgeting based on calendar periods was usually based on dividing the year into four-week periods. Ideally, the budgeting period fits the company's specific needs, but there are some clear benefits to basing your monthly budget on a bi-weekly pay template.

The first step is to create a budget framework based on a bi-weekly payment schedule, even if this is not how frequently you or your company gets paid. When you break these numbers down in your template, be sure to include every single purchase and expense within your ongoing budget. Divide your monthly expenses by two (or your yearly expenses by 24).

By budgeting in this manner, you will find it helps your company take care of the essential bills first. In your analysis, don’t overlook your company incurs' payments, which are not as readily apparent, including training of staff, insurance, payroll, software, and others.

Make Detailed Estimates

Be sure to make detailed estimates for all project costs. To get the ball rolling, a useful starting point is determining your resource cost rates. This includes your costs as far as labor and materials are concerned. You also should factor in your budget analysis on the need for external contractors, cost overruns, changes in project scope, and schedule variance.

Then you will want to factor in your income or anticipated income. In this section, you may want to include any projected discounts or refunds that you may expect.

Break your budget down into activities so that you can calculate the overall costs fairly accurately. Generally speaking, every activity has a start date and a finish date, which gives you some clarity around your budgeting needs. Using this detail in your bi-weekly budget will help you make informed decisions.

By factoring these into your bi-weekly budget template, you should be able to estimate your final project cost. By creating a budget summary, you should have a fairly precise idea if you have enough money to pay for the expenditures you foresee in your bi-weekly budget from the outset.

Your budget estimation and tracking can be done via an excel spreadsheet and done via the same excel spreadsheet. Alternatively, you can use more advanced software, so long as the method allows you to compare your forecasted numbers with the actual numbers at much closer intervals, being bi-weekly. As time passes on, your estimates can become more refined.

Input Fixed Expenses Versus Changing Expenses

As part of your bi-weekly budget template, be sure to include fixed and regularly occurring expenses and have these separate from what is known as your changing or variable expenses. Examples of fixed expenses include rent, loan payments, or pre-paid costs, whereas changing expenses can include utilities, supplies, and maintenance. For payments that are fixed, you can break these down into their bi-weekly equivalent.

It will, of course, be useful if you already have these averages to work with based on your previous projects. If you are starting from scratch, it may be worth the time to research the costs associated with the type of work you will be undertaking and estimating a budget based on the data available.

Budgeting From A Broader Perspective

Bi-weekly budgeting commits you to undertake a particular projection. When broken down, bi-weekly budgeting is essentially about planning and control. It is ultimately up to you and your business which of these is the most important. Ask yourself the question: should your budget be fixed, or should it be flexible?

By monitoring your expenditures at this level, you can compare the difference between the actual numbers and the numbers you budgeted for. If your budget was not in line with your actual numbers, you should be able to determine the cause of that fairly quickly and accurately. You can then revise the budget for the next month, or even year, with this information in mind.

If your business expenditures can or need to be reduced, using this bi-weekly template should give you an idea of the types of costs that are not essential to your work and can be either reduced or discarded completely.

Features Of Bi Weekly Budget Template

Bi Weekly Budget

1. Budgeting weekly is the fundamental and most important tool for managing money. It allows you to access money utilized for the project and provides you 100% control.

2. It helps you to avoid spending on useless services, unnecessary fees that are cutting off your goals. It will help you create a cover for unexpected expenses such as traveling repairs etc.; if you have a fixed weekly budget template, it will allow you to have full control over your money and achieve your objective every week without much stress.

Benefits Of Bi-weekly Budget

The budget provides several benefits to project managers :

- Establish guidelines and objectives for the project.

- The project manager can determine how much cost can be spent on each component.

- Prioritizing: It allows for prioritizing the different parts of the project, which to be completed first, while others to be kept on hold.

- Future Planning

Consult A Professional Service

It goes without saying that a trusted professional can help you budget in a way that will work best for your individual needs to plan ahead and allocate funds wisely.

Related articles that may interest you -

To learn more about Project Management, as well as the services Techno-PM can provide to help you on your journey to budgeting success, visit our website and contact us today.

Leave a comment