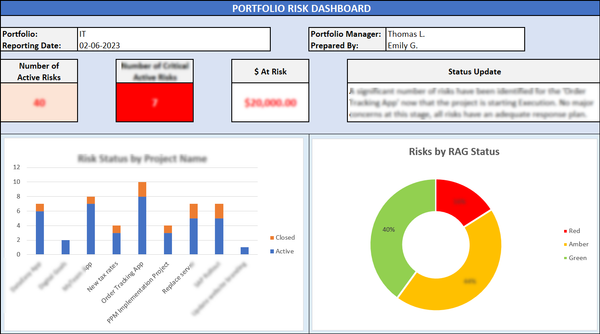

Portfolio Risk Dashboard Excel Template

Introduction

In the world of investments, understanding and managing risks are crucial for achieving financial success. A powerful tool that provides investors and portfolio managers with valuable insights into their investment risk is the "Portfolio Risk Dashboard." This dashboard offers a holistic view of the potential risks faced by a portfolio, empowering stakeholders to make informed decisions and implement effective risk management strategies. In this blog, we will explore the key components of a portfolio risk dashboard and its significance in assessing risk exposure.

What Is The Use of Risk Dashboard Portfolio?

A Risk Dashboard in the context of risk management is a tool that provides an overview of various risks associated with a portfolio of projects, investments, or other assets. It's a visual representation of key risk indicators and metrics that allow decision-makers to quickly assess the overall risk exposure and make informed decisions to mitigate or manage those risks.

Here's how it's used and its significance:

1.Risk Visibility: A Risk Dashboard consolidates and presents risk information in an easily understandable format. It helps stakeholders gain a clear understanding of the current risk landscape, highlighting areas of concern and allowing for early identification of potential problems.

2.Risk Prioritization: The dashboard allows risks to be categorized and prioritized based on their potential impact and likelihood. This helps in focusing resources on addressing the most critical risks first.

3.Communication: The dashboard serves as a communication tool between different stakeholders, including project managers, executives, and investors. It ensures that everyone is on the same page regarding the state of risks and their potential impact.

4.Early Warning System: A well-designed Risk Dashboard can serve as an early warning system, flagging potential issues before they escalate. This allows for timely interventions and adjustments to project plans or investment strategies.

5.Performance Tracking: Over time, the dashboard can help track the effectiveness of risk mitigation strategies. By comparing historical data, organizations can assess whether their efforts are reducing risk exposure and improving overall portfolio performance.

6.Customization: Depending on the organization's needs, the dashboard can be customized to display specific types of risks, metrics, and visualizations. This ensures that the dashboard aligns with the organization's risk management goals.

7.Regulatory Compliance: In industries where regulatory compliance is crucial, a Risk Dashboard can aid in demonstrating that the organization is actively monitoring and managing risks in accordance with regulations.

8.Continuous Improvement: Regularly updating and reviewing the Risk Dashboard fosters a culture of continuous improvement in risk management practices. As new risks emerge or existing ones evolve, the dashboard can be adjusted to reflect these changes.

A Risk Dashboard portfolio plays a vital role in risk management by providing a comprehensive and easily accessible view of risks, helping organizations make well-informed decisions to protect and enhance their portfolios.

What Is The Purpose of Showcasing a Risk Dashboard Portfolio?

A Risk Dashboard Portfolio is a visual representation or tool that aggregates and displays the risks associated with a collection of projects, investments, assets, or any other related entities. It provides a comprehensive view of the risk landscape across multiple elements within a portfolio. This tool helps organizations and decision-makers monitor, analyze, and manage risks effectively.

One of the fundamental features of a portfolio risk dashboard is the ability to view risk status by individual project names. This component allows investors to identify and analyze the risks associated with each project within the portfolio. By assessing risk status for each project, investors can pinpoint areas that require attention and prioritize risk mitigation efforts accordingly,

The following aspects are encompassed by this tool.

1.Risk by RAG Status: The "Red-Amber-Green" (RAG) status system categorizes risks based on their severity. In the portfolio risk dashboard, risks are color-coded as red (high risk), amber (medium risk), or green (low risk). This visualization enables stakeholders to quickly identify critical risks and potential vulnerabilities that demand immediate action. It also assists in tracking risk trends over time.

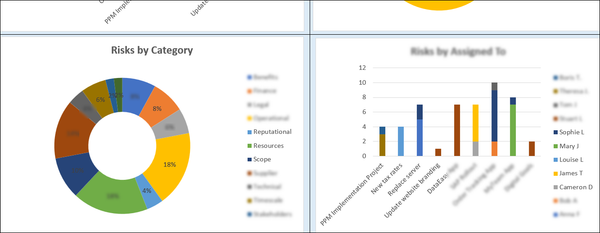

2.Risk by Category: Investment portfolios often encompass a wide range of assets and industries. The dashboard categorizes risks based on different asset classes or investment categories. This segmentation aids in understanding the diversification of risk across various investments and industries. By assessing risk by category, investors can assess the impact of each asset class on the overall portfolio's risk exposure.

3.Risk by Assigned To: The portfolio risk dashboard assigns risks to specific individuals or teams responsible for managing them. This feature ensures accountability and facilitates communication among stakeholders. By identifying the parties accountable for mitigating specific risks, prompt actions can be taken to address and control potential threats effectively.

4.Raw Data: Raw data is the foundation of the portfolio risk dashboard. It includes all relevant risk-related information, such as historical returns, volatilities, correlations, and other risk metrics for each asset or investment. This raw data is processed and visualized in charts and graphs, offering a clear understanding of the portfolio's risk profile.

5.All Portfolio Risk: The crux of the portfolio risk dashboard lies in the all-encompassing view of the portfolio's overall risk. This component brings together data from individual projects, RAG status, risk categories, and risk owners to provide a holistic risk assessment. By evaluating all portfolio risks collectively, stakeholders can develop a comprehensive risk management strategy that aligns with their investment objectives.

Benefits of Risk Dashboard Portfolio

The benefits of a Risk Dashboard Portfolio in the context of risk management are as follows:

1.Comprehensive Overview: It provides a holistic view of risks across the entire portfolio, allowing for a better understanding of the cumulative risk exposure.

2.Early Detection: Enables the early identification of potential risks, enabling timely interventions and preventive actions.

3.Informed Decision-Making: Facilitates data-driven decisions by presenting risk metrics, trends, and scenario analysis, improving the quality of strategic choices.

4.Risk Prioritization: Allows for the prioritization of risks based on their significance and potential impact, ensuring that resources are allocated where they're most needed.

5.Performance Tracking: Helps assess the effectiveness of risk mitigation strategies and track changes in risk exposure over time.

6.Customization: Can be tailored to fit the specific needs and preferences of the organization, ensuring that the dashboard aligns with the unique risk management requirements.

7.Regulatory Compliance: Assists in demonstrating compliance with regulatory standards by showcasing active risk monitoring and management practices.

8.Continuous Improvement: Encourages continuous improvement in risk management practices as new risks emerge or existing risks evolve, leading to a more resilient and adaptable organization.

Overall, a Risk Dashboard Portfolio provides numerous advantages that empower organizations to proactively manage risks, optimize resource allocation, and make well-informed decisions, ultimately contributing to the overall success and resilience of the portfolio.

Conclusion

The portfolio risk dashboard is a powerful tool that empowers investors and portfolio managers to make well-informed decisions by assessing and managing risks effectively. With its detailed insights into risk status by project name, RAG status, risk categories, assigned risk owners, and raw data, stakeholders gain a comprehensive view of the portfolio's risk exposure. Armed with this knowledge, they can proactively take measures to safeguard their investments, maximize returns, and navigate the ever-changing landscape of the financial markets with confidence. By leveraging the portfolio risk dashboard, investors can optimize their investment strategies and achieve their long-term financial goals.